capital gains tax canada crypto

As another example suppose you sell that Ethereum for 4000 in Bitcoin. The CRA reviews specific crypto.

Crypto Taxation In The Finance Act 2022 The Indian Conundrum Lexology

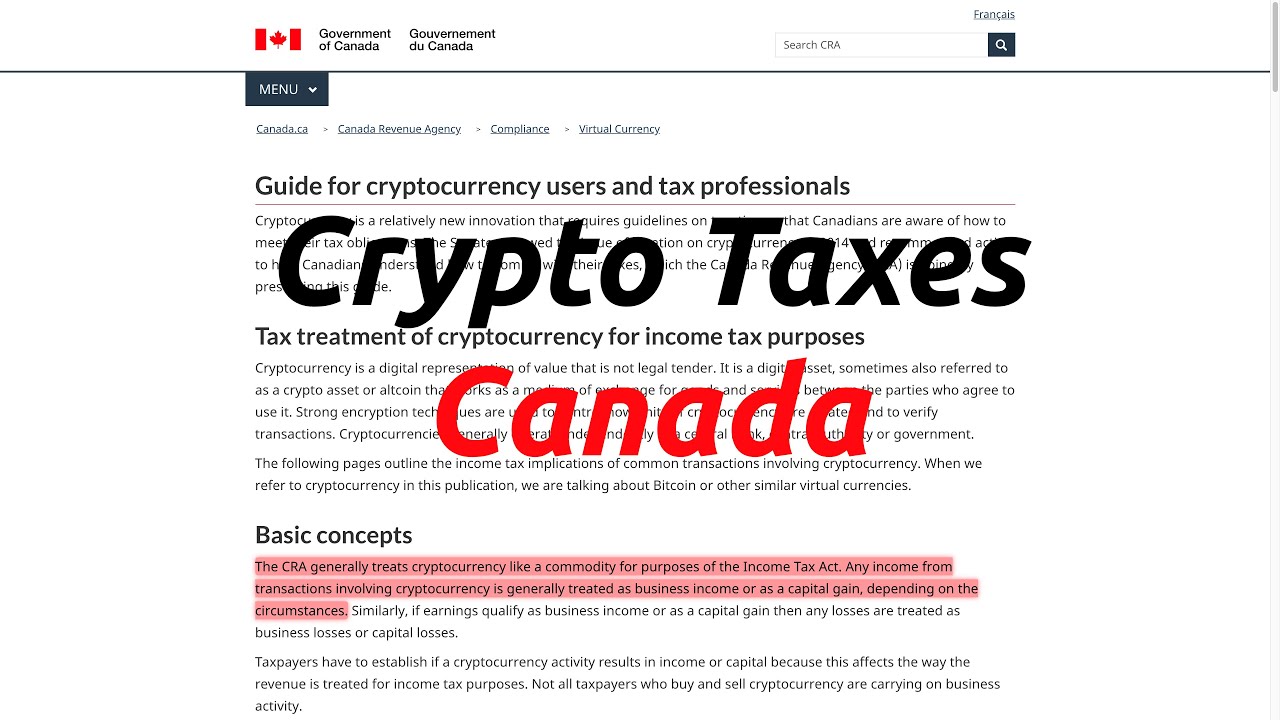

You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

. You need to report your taxable crypto transactions on your Canadian personal income tax return T1 General. If youre married filing jointly with a combined income of 100000 you might pay 22 in taxes on your short-term capital gains 7524 342 x 22 and take home 26676 in. Remember you will only pay tax on your.

As such someone who received 1 BTC at 10000 and sold it at 15000 would owe 150 of income tax for 2018 half of their profit and an additional 3750 of income tax. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Interestingly only half of your capital gains are taxable.

This is called the taxable capital gain. Similar to other types of capital gains you will need to report your total cryptocurrency capital gains to the Canada Revenue Agency using the Schedule 3 Capital. There are some instances where a crypto.

Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. This means that 50 of your gain is added to your income for the year and charged at your marginal rate. While theres no way to legally cash out your crypto without paying taxes theres.

Thus if an investor buys 10000 worth of crypto from an exchange the investor has to pay tax on crypto in Canada. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax. For example if you have made capital gains amounting to 20000 in a certain year only 10000 will be subject to capital gains tax.

So for example if you realize a gain of 10000 on selling a few Bitcoins youll only pay capital gains. Canada Tax Deadlines 2022 - 2023 The tax year in Canada runs from the 1st. Investors hold crypto assets for capital investment or to earn through short or long-term gains.

You can then carry forward 1000 of losses for future tax years. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Crypto in Canada is subject to Income Tax or Capital Gains Tax - depending on the specific transaction.

In fact there is no long-term or short-term capital gains. Subject to any applicable extensions the federal income tax filing and payment. How is crypto tax calculated in Canada.

Note that only 50 of capital gains are taxable. With no gains in the current tax year you use 4000 to offset your capital gains from 2021. Capital Gains Vs.

The tax return for 2021 needs to be filed by the 30th of April 2022. If your crypto investments are seen as capital gains youll only pay tax on 50 of your total gains.

A Guide To Crypto Friendly Countries Get Golden Visa

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit

Crypto Capital Gains And Tax Rates 2022

Crypto Taxes Canada 2020 Capital Gains Vs Business Income Youtube

Is Cryptocurrency Taxable In Canada What You Need To Know About Crypto Taxes

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

10 Best Crypto Tax Software In 2022 Top Selective Only

Global Law Experts Global Law Experts Newsletter December Article Is Bitcoin Taxable In Canada

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Cryptocurrency Taxes In Canada Cointracker

Canada Crypto Tax Guide 2022 Crypto News

Cryptocurrencies And Other Digital Assets Take Center Stage In 2022 Part 2

How Do I Manually Report My Cryptocurrency Gains Or Losses Help Centre